| « How Israel Wages War in Plain Sight | Running Out Fossil Fuels: A Cause For Glee? » |

Screwing the Self Employed Out of Health Insurance

>The Sleeping Giant of Health Reform

If you work for yourself, you are literally screwed out of large sums of money every year for health insurance. There are few differences in cost based on region or state regulation. Ultimately, plans in Salt Lake City and Boston cost the same, about $17,000 a year (premiums plus deductibles). Despite the costs, many self employed are grateful to just have insurance since without it a major acute or chronic illness can bankrupt a family and the absence of care can be fatal.

The self employed are denied insurance on a regular basis due to preexisting conditions. When they're able to get health insurance, they pay more for premiums and their deductibles are higher than any other group. Even after a federal income tax deduction, the cost of health insurance is the equivalent of annual payments for a condominium, at the low end, or a medium sized home, at the top of the cost scale.

A study by the Bureau of Labor Statistics found ten million self employed and another group of nearly five million single employee corporations. That's 11% of the total workforce that gets gouged year in and year out by the current health care system.

Any informed self employed person would welcome the opportunity to leave these ultra high cost, under performing plans. Plan selection would be pragmatic making it likely that a public option would be high on the list of preferences.

Why? The total cost of insurance is the obvious reason. For many, the "preexisting condition" clauses in health insurance contracts are used routinely to exclude self employed applicants and family members who have a serious illness. Even worse news awaits the self employed. Without major changes over the next few years, there will be a scarcity of comprehensive plans, even the exorbitantly priced plans available today. Cost, discrimination, and scarcity are strong motivations for real change.

This independent, entrepreneurial group of fifteen million struggles to get affordable health insurance in almost every state.

You think that these people might have a complaint or two about the pricing and coverage available from the current health care system?

Why couldn't they be an active, strong force for health care reform?

Is their case being made? Is their support sought in the health reform debate? They're not likely to show up screaming at health care town halls. They need to work more every year just to cover their health care expenses.

The self employed face major challenges in obtaining decent health insurance only to be guaranteed uniformly high prices where ever they live

The self employed purchase health insurance directly from health insurers as an individual or family. This is entirely different than the experience of wage and salaried workers who receive a health insurance benefit from their employer. Employers generally pick up the majority of the monthly costs, which can average around $1000 to $1200 per employee. Employees typically pay only a portion of this total cost, from 10% to 20%.

Wage and salaried employees rarely see the true cost of health insurance. Why should they? It's a benefit, a part of their employment contract. The self employed, however, are well aware of these costs when they pay their premiums and deductibles every month.

Not all of the fifteen million self employed citizens purchase health care directly. Some benefit from a spouse with subsidized coverage through a business or government agency. Nevertheless, they know that they're just a layoff away from the horrors of the direct purchase of health insurance.

Why not allow the self employed to cross state lines to buy less expensive health insurance? Wouldn't this solve the problem?

That's a myth based on massive distortions by the right wing business lobby and the uninformed like Whole Foods Markets' CEO John Mackey.

Mackey's sentiments are shared by the National Center for Policy Analysis (NCPA) of Dallas, Texas in this analysis on Small Business Health Insurance. The study compared health insurance premiums in three "heavily regulated" states (Massachusetts, New York, New Jersey) with three "lightly regulated states" (Michigan, Utah, Wisconsin) and found much higher premiums in the lightly regulated states. New York premiums came to $12,000 a year while Wisconsin's were only $3,000 annually.

This is a shameless distortion. The NCPA comparison leaves out one critical element of health coverage -- the deductible for each of these plans. To obtain any benefit from health insurance, hefty deductibles from $5,000 to $16,000 must be met before the first insurance payment ever takes place. The only benefit found in "lightly regulated" states was to insurance companies by allowing them to quote premiums only without including the cost of deductibles.

The Self Employed Pay Too Much No Matter Where They Live

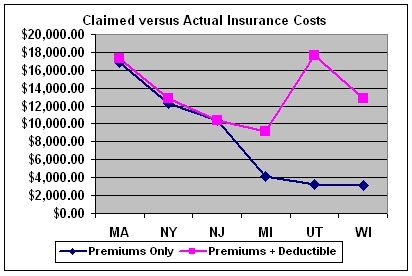

The graph below shows the claimed benefits of buying health insurance in "lightly regulated" states -- Michigan, Utah, and Wisconsin -- compared to "heavily regulated" states -- Massachusetts, New Jersey, and New York. True insurance costs were calculated for the graph below by adding (a) the cost of the premiums plus (b) the total plan deductible. The pink line represents a basic dollar for dollar comparison. The blue line uses the NCPA figures which show premiums only.

Blue line from NCPA analysis (premiums only). Pink line (premiums plus deductibles) from Insure.Com ("Get Quotes") for the state capitols of each state. Quotes here.

The right wing NCPA analysis (blue line) is entirely misleading since the low premiums in Michigan, Utah, and Wisconsin are offset by very high deductibles ($5,000, $16,000, and $10,400 respectively). For an insured to reach dollar one of insurance payments, he or she must cover costs to the limit of the deductible. Once deductibles are added, the real world costs of health care are higher in the "lightly regulated" states of Utah and Wisconsin than in the "heavily regulated" states of New York and New Jersey. Costs are equal in Utah and Massachusetts.

Mobilize the Self Employed

When your health insurance costs are so high they could buy you a home, you know they're too high. What are the alternatives for the self employed? There are none. If you have insurance, you pay because you need at least some coverage and a hedge against catastrophic expenses. The self employed are trapped and have no viable choices.

The self employed are the ideal group for a strong appeal to support overall health reform and a viable public option. It's a good deal for the self employed and it promotes job creation as well.

The Congressional Democrats and Obama administration need all the allies they can get. How about serious health care reform with a public option. How about actually making an appeal to the self employed? It's not too late.

END

Disclosure: The author is self employed.

This article may be reproduced in whole or in part with attribution of authorship and a link to this article.