| « Question 6 for 9/11 Smarties: Why was Building 7, that wasn’t hit by a plane, demolished 8 hours after the second tower collapsed on September 11, 2001? | More Government Lies and Deceptions » |

The New Pyramid Scheme - Corporate Tax Breaks and Derivatives

Michael Collins

The real threat to the United States is the ongoing economic decline, jobs that they tell us will never return, no new jobs and flat income since 2000, and financial schemes that make a tiny fraction even wealthier while the nation as a whole struggles and declines.

Speculation reigns supreme in your nation’s capital. Who is next in line after the bin Laden operation? The bipartisan coalition directing the war on terror forgot one important fact about the security of the United States of America. It doesn’t matter who they kill overseas, the assault on almost all citizens continues unabated at home. No one is doing anything to stop it. Only the financial and political elite remain immune. (Image-WikiCommons)

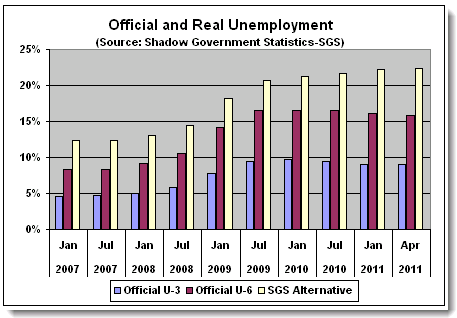

According to the National Bureau of Economic Research, the national economic collapse (aka recession) ended June 2009. That’s news to the 55% of the public that believe we’re in either a recession or depression (April 2011).

Official unemployment is around 9%. That excludes the marginally employed and under employed. Adding those two groups takes unemployment up to 15.9%. Add the long-term unemployed and the figure climbs to nearly 23%.

The total of all types of unemployment and underemployment approached Great Depression levels in 2009. (Link)

When you have 23% real unemployment/underemployment among those willing and able to work, you have budget deficits at every level of government. Businesses fail or slow down. Governments reduce or eliminate services. People lose their homes and health insurance. Credit ratings dive, making it more expensive or impossible to borrow for any reason, including emergencies. The unemployed contribute much less to the economy, which shrinks substantially, leading to more under or unemployment. There future darkens. All that’s left is hope, a commodity of little use today.

If you’re part of the financial elite in crowd, you don’t need hope. You’re about to get another big payday. Much lower taxes and relaxed regulation of foreign exchange derivatives are on the way.

More Corporate Welfare – Tax Breaks for Those with all the Breaks

Obama administration Treasury Secretary Timothy Geithner plans an overhaul of the corporate tax rate. His boss, the president approves, no doubt. Politico reports that Geithner’s proposal will reduce corporate income tax from the current 35% to between 26% and 28%. This is a charade since few major corporations pay anywhere near the proposed 26%. ATT paid federal income tax of 2.7% last year. General Electric, with pretax profits of $10.3 billion, paid nothing and got a $1.1 billion tax benefit.

The administration’s proposed corporate tax breaks are window dressing to obscure corporate tax breaks that reduce what corporations actually pay, around 17% a year according to one study. There will be no provision to rectify the difference between tax rates on domestic corporate income, 35%, and the 15% corporate tax for income gained overseas.

Will we see loopholes closed that keep most corporations from even coming close to paying the full amount of income tax?

Count on hearing that US corporate tax rates are the highest in the world. This is simply untrue when you count the taxes actually collected. According to the Organisation for Economic Co-operation and Development (OECD), US corporate taxes accounted for 2.1% of the US gross domestic product (GDP-see graph) in 2009, highly favorable compared to the rest of the industrialized world.

To offset any lost tax revenues, Geithner’s plan will end some key tax benefits for US manufacturing companies. We can assume that these manufacturing companies will cover the tax benefits for multinationals until the last manufacturing job leaves the United States.

In what appears to be high comedy, Politico reported that,

“Aides say Geithner will personally dive into the negotiations. House Speaker John Boehner also sees this as a ripe area for bipartisan cooperation.”

This defies belief. Negotiations require differences. When it comes to corporate policy and subsidies, there is just one party position; that of the bipartisan coalition called The Money Party.

The Forth Horseman of the Looming Collapse – Derivatives Unleashed (again)

Secretary Geithner has been a very busy White House policy operative. While he’s giving away the store on corporate taxes, he fails to remind us that Treasury wants to exempt certain currency derivatives – swaps and forwards – from the recently enacted Dodd-Frank financial industry reforms. Recall that the collapse of the Wall Street derivatives scheme, subprime mortgage backed securities, was largely responsible for kicking off the current economic decline.

Derivatives are risky financial instruments largely outlawed until 2000. The 1999 repeal of the Glass Steagall Act barring banks from risky investments and enactment of the Commodity Futures Modernization Act of 2000 changed all that. These bipartisan legislative efforts became the enabling acts for the reckless ride to ruin thanks to Wall Street and the big banks

What are President Barack Obama and Secretary Geithner up to?

Gary Gensler, Commissioner of the Commodity Futures Trading Commission (CFTC) has a clear picture of the Obama – Geithner scheme. Gensler sent a letter to the US Senate in August 2009 objecting to a proposal similar to the one Geithner just released. He said,

“Currency and interest rate swaps could be broken down into their component parts and then restructured to resemble a series of foreign exchange forwards or a foreign exchange swap to come within the scope of these foreign exchange exclusions and thereby avoid regulation.” In other words, this proposal opens the door to wider currency speculation.

The exemption for foreign exchange currency swaps and forwards would enable Wall Street and the big banks to continue doing what they have done all along, engage in irresponsible and damaging currency speculation of the type that ruined the economy of Greece, for example.

Commissioner Gensler pointed out that, “these exclusions may have the unintended consequence of undermining the CFTC’s enforcement authority over retail foreign currency fraud.” The use of “unintended consequence” is a generous appraisal for a move by Treasury that makes fraud easier. We can better judge Geithner’s motives as self-evident from the predicted outcome.

Back to the Future

Gensler made another critical point regarding Geithner’s 2009 proposal for over the counter derivatives trading, language that made it into the Dodd-Frank financial reform package:

“The Proposed OTC Act provides for mandatory clearing and exchange trading of standardized swaps. It creates an exception, however, from the mandatory clearing and trading requirements when one of the counterparties is not a swap dealer or major swap participant (and does not meet the eligibility requirements of any clearinghouse that clears the swaps)” Gary Gensler, Commissioner CTFC, August 2009.

New York Times, December 10, 2010

The informed public is already suspicious of Wall Street’s secrecy and market manipulation. The New York Times headline of December 10, 2010 shows the realty of the situation. This is happening under the Dodd-Frank financial reform legislation. What happens when Gensler’s prediction of a separate, unregulated derivatives market operates without regulation as allowed by the financial reform? Another meltdown is in the works thanks to the legislation we were told would make sure that never happened again.

We live in an upside down world. The real threat to the United States is the ongoing economic decline, jobs that they tell us will never return, no new jobs and flat income since 2000, and financial schemes that make a tiny fraction even wealthier while the nation as a whole struggles and declines.

END

This article may be reproduced entirely or in part with attribution of authorship and a link to this article.