| « The Grave Threat of Possible Nuclear War | Latin America: The Pendulum Swings to the Right » |

GOP Tax Cut Swindle: A $236 Billion Bonanza for Corporate Predators

Stephen Lendman

According to a report prepared for Senate Dems, 15 of America’s largest corporate predators reaped a nearly $4 trillion windfall over the last 30 years.

It came from federal giveaway subsidies, tax credits and bailouts, along with $108 billion in government contracts, many no-bid.

The largest corporate welfare beneficiaries include Apple, Pfizer, Microsoft, GE, IBM, J&J, Merck, Google, ExxonMobil, Procter & Gamble, Citigroup, Chevron, Goldman Sachs, Eli Lilly and Walmart.

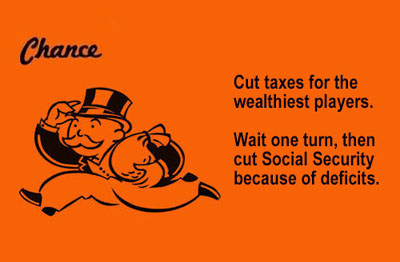

The GOP tax cut swindle will give corporate predators another $236 billion over the next decade - at the expense of eroding social justice to partly pay for it, the remainder adding around $2.5 trillion to the deficit and national debt, according to David Stockman, not the $1.5 trillion claimed.

Corporate predators use every devious means possible to evade taxes, including maintaining revenues and profits abroad in low-tax or no-tax havens.

In collusion with corrupt politicians, bribed with campaign contributions, they pay far less than their fair share, unfair benefits not afforded ordinary Americans.

In the notorious Cayman Islands tax haven alone, a single five-story building is the registered home of over 18,000 corporations.

Accounting and legal tricks are used to avoid federal, state and local taxes. Billionaire Leona Helmsley once notoriously said “(o)nly the little people pay taxes.”

Things are much more unfair now than when she said it. The corporate windfall from the great GOP tax scam will go for share buybacks, executive pay and bonuses, along with greater ability to grow larger and more powerful through mergers and acquisitions - not investments for growth or jobs creation as falsely touted.

According to the report, the GOP tax swindle “encourages companies to shift their jobs and profits overseas by moving to a ‘territorial’ tax system that would exempt future offshore profits of US subsidiaries from taxation.”

According to the Tax Policy Center (TPC), the largest beneficiaries by far from the GOP bill will be corporate giants and super-rich households.

Middle-income households will receive a modest benefit next year, eroding over time, disappearing altogether by 2025 “when nearly all of the bill’s individual income tax provisions are due to expire, (after which) only high-income people would get a meaningful tax cut,” TPC explained.

Around 20% of US households will get no tax benefit next year. About 5% will pay more than now, 7% of middle-income households to pay more, 45% of low-income households to get nothing.

After expiration of enacted provisions, over half of US households will pay more than now.

Corporate predators will keep all their ill-gotten gains, courtesy of GOP swindlers, benefitting along with their corporate clients.

Most ordinary Americans will lose out with little or no benefits, many with higher taxes, and everyone with greatly eroded social programs they rely on.

-###-

Stephen Lendman lives in Chicago. He can be reached at lendmanstephen@sbcglobal.net.

VISIT MY NEW WEB SITE: stephenlendman.org (Home - Stephen Lendman)

My newest book as editor and contributor is titled "Flashpoint in Ukraine: How the US Drive for Hegemony Risks WW III."

Listen to cutting-edge discussions with distinguished guests on the Progressive Radio News Hour on the Progressive Radio Network.

Virus-free. www.avg.com