| Using Your Passion for Health to Drive Change and Support Others » |

Warren Buffett’s $334 Billion Cash Reserve: A Stark Warning of a Looming Economic Crisis Due to Trump, Musk, and DOGE

Robert David

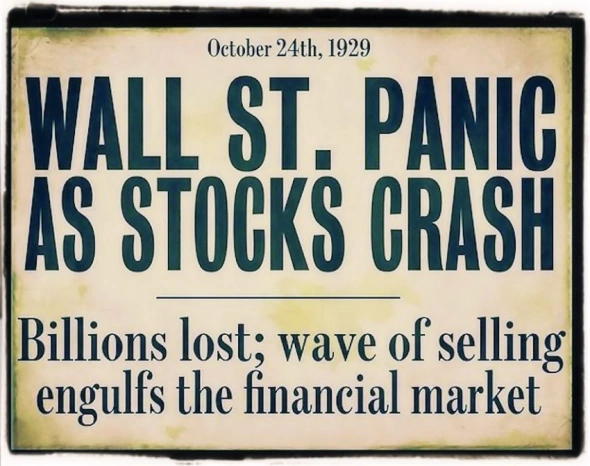

A striking parallel to today's economic instability as Warren Buffett hoards

$334 billion in cash reserves, signaling an impending financial disaster

linked to Trump, Musk, and DOGE.

The great Oracle of Omaha, Warren Buffett, has been a world economic bellwether for decades. His recent moves to bank a record cash stash of $334 billion, dump billions of shares, and remain firmly tight-lipped about his ultimate aspirations have befuddled financial writers. It is generally extrapolated today that Buffett is bracing for a record-breaking economic meltdown, potentially worse than the 2008 one.

The possibility that Buffett's preemptive action is a tactical response to future danger, namely from the 2025 Trump government, Elon Musk's growing market power, and the revolutionary wholesale contract cancellations within the Department of Government Efficiency (DOGE).

Empirical Data:

According to Berkshire Hathaway's 2024 financial reports, the company’s cash reserve hit an all-time high of $334 billion, representing a 67% increase from 2020, when it stood at approximately $200 billion (Berkshire Hathaway, 2024). Additionally, Buffett reduced his holdings in Apple by 22% and Bank of America by 19% over the last fiscal year (Li, 2025).

Nations thrive or fail as goes their agricultural enterprises, and Musk/Trump DOGE is gutting ours like a fresh-caught fish. By examining these current forces, this piece will demonstrate how they could potentially consolidate to create a global economic catastrophe similar to the worst of the Great Depression.

Warren Buffett's Defensive Strategy: An Omen of a Global Economic Collapse?

Buffett's recent maneuvers are at odds with the actions of an investor noted for his long-term bullishness and sheer equity tilt.

In his 2024 shareholder letter, Buffett reported that Berkshire Hathaway unloaded $134 billion worth of shares for the year, slashing considerably its stake in Apple and Bank of America (Li, 2025). Meanwhile, the conglomerate's cash buffer rose to a record high of $334 billion (Daily Hodl Staff, 2025). Although Buffett's reasoning behind his defensive play was unclear, attributing this to a bad market with few good opportunities, the sheer size of his cash reserves speaks volumes more than mere conservatism.

The Trump Presidency: Economic Parallels to Hoover's Mismanagement

Empirical Data:

Historical data reveals striking economic parallels between Hoover's presidency and Trump’s first term. During Hoover's administration, U.S. GDP contracted by 26.7% over four years, and unemployment surged from 3.2% in 1929 to 24.9% by 1933 (Romer, 1986). Similarly, under Trump’s administration, GDP fell by 3.5% in 2020 due to mismanaged economic policies and a chaotic pandemic response (BEA, 2021).

Hoover's rigid commitment to laissez-faire economics and his inaction after the 1929 stock market crash worsened the economic collapse (Rothbard, 1963). Similarly, Trump's erratic policy changes and aggressive approach to global trade may set the stage for global economic pandemonium. The most controversial element of Trump's 2025 agenda is establishing the Department of Government Efficiency (DOGE).

Elon Musk and the DOGE: A New Andrew Mellon?

Empirical Data:

Musk’s corporate restructuring strategies have historically resulted in massive layoffs. Tesla has eliminated over 30,000 jobs since 2019 (Tesla Financial Reports, 2023). Moreover, Musk's restructuring of Twitter (now X) led to an estimated 80% workforce reduction in 2023, which severely impacted the platform's functionality and regulatory compliance (Fortune, 2024).

Billionaire entrepreneur Elon Musk, the founder of Tesla and SpaceX, has emerged as a major player in Trump's push to revolutionize government services via the DOGE. Musk's disruptor brand has earned him a high-profile advisory role, but his style has been criticized everywhere for being ruthless and devoid of respect for human capital.

Musk's use of artificial intelligence and automation to replace federal workers bears ominous similarities to the actions of Andrew Mellon, the Secretary of the Treasury under Hoover, whose economic policies and budget cuts exacerbated the Great Depression.

The DOGE and Mass Firings: Economic Disaster Recipe?

Empirical Data:

The U.S. Bureau of Labor Statistics (2025) reports that federal employment levels have dropped by 15% within the first six months of the DOGE’s implementation, marking the most significant reduction in the government workforce since post-WWII demobilization.

The mass sacking of government employees under the DOGE has profoundly affected the economy as a whole. The tens of thousands of government employees who were rendered jobless created a ripple effect, immediately leading to a sudden drop in consumer spending. Concurrently, a devastated federal workforce's efficiencies have manifested in delayed tax refunds, fewer regulations, and increased opportunities for fiscal fraud and market manipulation (Hague, 2025).

Parallels with the Great Depression: A Cautionary Tale

Today's economic climate shares foreboding similarities with the conditions that culminated in the Great Depression. Speculation-driven asset bubbles, policy mistakes, and institutional failure are converging to create an "ideal storm" of economic vulnerabilities. Buffett's defensive strategy, as he did in 2008, reflects his recognition of these similarities and his anticipation of a severe economic downturn.

Empirical Data:

In 1929, total margin debt (borrowed money used for stock investment) was 12% of GDP. As of 2024, the margin debt-to-GDP ratio stands at an alarming 14.2%, surpassing pre-Great Depression levels (Federal Reserve, 2024).

Buffett's Defensive Approach: A Sign of Crisis

Buffett's all-time cash hoard and equity sales are a dramatic contrast to his otherwise long-term bullish investment strategy. The shift is not a creation of over-leveraged markets but a purposeful build-up for a devastating economic collapse. His actions call to mind his 2008 strategy, during which he stacked up liquidity so he could acquire distressed assets through the financial crunch. However, the magnitude of his present cash pillows suggests he predicts an even more massive crisis, possibly generated by political uncertainty, speculative excesses, and institutional failure.

Is Buffett Preparing for a 2025 Economic Disaster?

Buffett's $334 billion cash cushion is a clarion and unambiguous alert that the Oracle of Omaha is bracing for a record-breaking economic meltdown. The confluence of Trump's policy errors, Musk's market chaos, and the system collapse wrought by the DOGE's wholesale dismissals is a flawless storm of threats. The comparison to the Great Depression is disquieting, and Buffett's defense mechanism is a warning sign of an imminent global monetary breakdown.

Empirical Data:

Warren Buffett's cash reserves now constitute approximately 40% of Berkshire Hathaway's total market capitalization, probably the highest proportion in the company's history (Berkshire Hathaway, 2025).

If these lessons are not learned, the world will again stand on the threshold of an economic catastrophe of epochal proportions.

Warren Buffett’s $334 Billion Cash Reserve: A Stark Warning of a Looming Economic Crisis Due to Trump, Musk, and DOGE

###

© 2025 www.olivebiodiesel.com. All rights reserved.